51 Insights

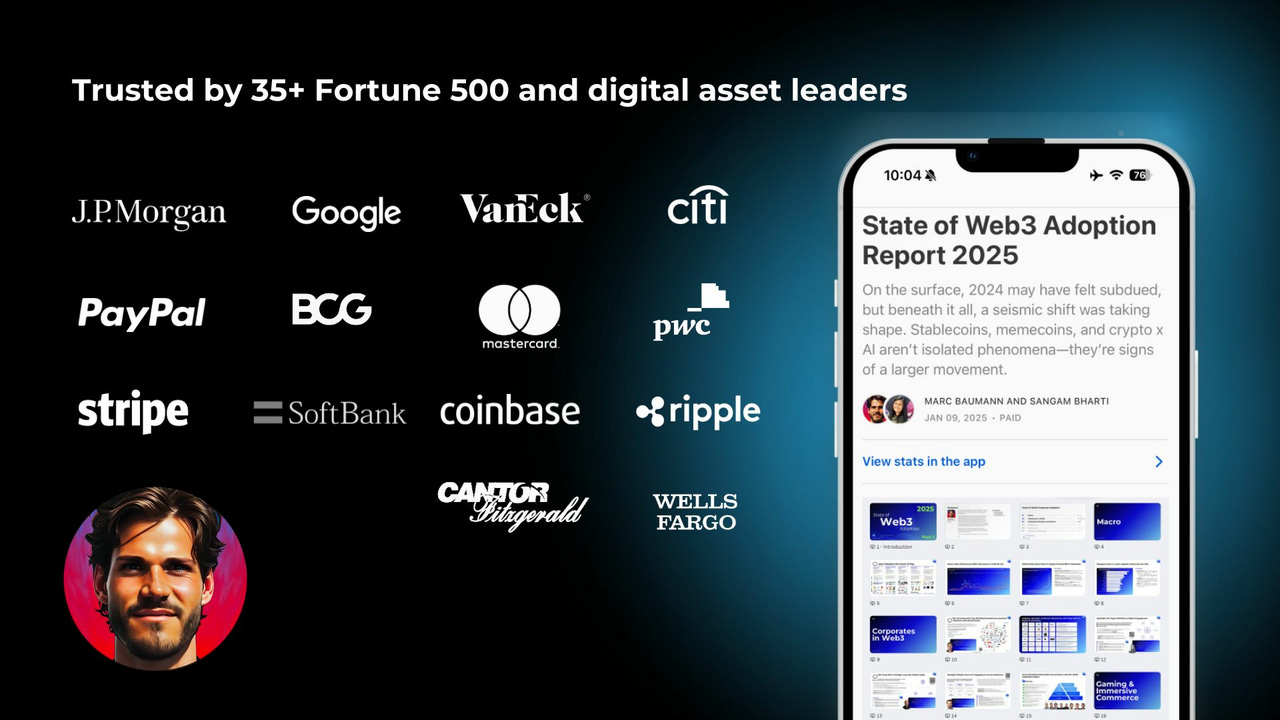

The industry's most actionable insights on digital assets. We cut through noise, explain what others can’t, so you can focus on what matters. 5 minutes a week. Join 35k+ subscribers (it's free) 👇

By subscribing, I agree to Substack’s Terms of Use and acknowledge its Information Collection Notice and Privacy Policy

“FiftyOne Insights is a premier resource on Web3, helping marketing leaders in growing their business.

Marc Baumann, the author of FiftyOne Insights, is a great ambassador for our space, and a trusted voice for valuable content. ”

Michael Nadeau, The DeFi Report

“The best research on Web3 for business leaders. Period. ”

Marc Baumann, AI Operator