📝 #68: What now?

After Starbucks. Web3 loyalty for restaurants. BlackRock's first tokenized fund. RWA boom. London Stock Exchange launches ETN. Coinbase record volume. SBF gets 25 in prison. Top charts & more.

Hey, it’s Marc. ✌️

This week, I published a case study on Gucci’s Web3 strategy for Harvard Business School. It’s also conference time again! Next week I’ll be at NFT NYC. Reach out by replying to this email.

Be inspired✨

“Wheresoever you go, go with all your heart.”― Confucius

📚 Top 5 Reads

Culture GPT. By Ana Andjelic. Link

Crypto Macro Summer kicks off. By Raoul Pal. Link

Memecoins as the New GTM Strategy. By Li Jin. Link

Why Brands Should Prepare for the Rise of Super Fans. By Paul Hiebert. Link

Content and engagement as social currency. By fil. Link

✨ Web3 & Brands

Starbucks is out – and now? 🤔

Many reached out to me asking what the end of Starbucks' Odyssey means for the Web3 consumer landscape as a whole.

A quick recap of the most important facts:

Starbucks announced the end of its Web3 loyalty program “Odyssey” by March 31. Link

Odyssey was seen as a benchmark of a Web3 loyalty play.

Polygon subsidized the program with $4M. Link

Starbucks made $1M+ revenue in year one, that’s about as much as one of its 38,000 stores globally.

What now?

We're entering a new phase of Web3 maturity, having seen many lackluster Web3 brand activations over the past two years.

What’s next? Brands want to:

solve real business problems (brand affinity, engagement, loyalty, cost savings, etc.)

generate actual ROI

This also means that Web3 isn’t just about NFTs anymore. Brands will start looking at this more holistically. Starbucks is a first inning of that.

Zooming out: We’re seeing four big shifts, driven by a variety of fintech tools, blockchain, disintermediation and decentralization:

From platforms —> network

From transactional incentives —> ownership incentives

From top-down —> bottom-up

From social relationships —> economically beneficial relationships

Punchline: Future brands will be hyper-personalized and make consumers to co-creators and co-owners with a stake in the value they help to create.

Food onchain in New York🍔

Blackbird sold out membership to its Blackbird Breakfast Club in less than 24 hours. Link

In 2022, Gary V’s Flyfish Club became the first restaurant to offer a token-gated member’s only private dining club. It has ,327 members and is on track to open in early 2024. Link

Best Dish Ever launched first tokenized community-owned media brand for foodies that’s pushing out high-quality content and real world restaurant perks for holders.

Zooming in: Blackbird has raised $24 million through a16z. It aims give many independent restaurants the means to identify and reward regulars for the first time.

How it works: Consumers earn rewards, restaurants earn tokens and receive valuable customer data.

Dive deeper: Web3, the future of loyalty? Read more.

Why it’s important: Blackbird is building an open, interoperable loyalty systems with onchain tokens. Interoperability is a key promise of Web3 based loyalty ecosystems, but it’s complex. Will food be the first working use case?

More on Web3:

Refik Anadol launched a Large Nature Model / Living Art with NVIDIA. Link

The Fabricant partners with Maison Margiela to bring their iconic Tabi boot into the digital world. Link

🌎 Crypto & Macro

Tokenization takes off🚀

BlackRock launched its first tokenized fund, BUIDL, on Ethereum Link

It enjoyed strong demand in its first week, attracting $245M in deposits.

The volume on Google Search trends for RWA is now surpassing Gaming. Link

Boson1 recently launched "Fermion," a protocol tailored for transacting high-value assets.

Zooming in: BlackRock's BUIDL, created with asset tokenization platform Securitize, is investment in a fund that holds U.S. Treasury bills and repo agreements.

What they’re saying: BlackRock thinks that tokenization will be the “next generation for markets” and “monumental in shaping our ecosystem.”

By the numbers:

The tokenized Treasury market has mushroomed over the past year, growing nine-fold from $100M in early 2023.

Boston Consulting Group (BCG) estimated tokenized assets could reach $16 trillion by 2030.

Why it matters: Tokenization makes a product more liquid, more secure, programmable and interoperable. With funds, this means instant settlement and around-the-clock subscriptions and redemptions.

J.P. Morgan started tokenising funds as a proof-of-concept last year.

UBS is testing a tokenized fund on Ethereum.

Punchline: We’re seeing institutional adoption happening in real time.

More on Crypto:

The London Stock Exchange is set to go live with their own Exchange Traded Notes for BTC and ETH later in May. Link

A US judge sentences Sam Bankman-Fried to 25 years in prison. Link

Goldman Sachs sees a resurgence in crypto assets from hedge fund clients. Link

Coinbase International sees record daily trading volume in March. Link

🧠AI + Metaverse

Amazon invests another $2.75B in Anthropic, the second tranche of its planned $4B investment in the AI startup, after investing $1.25B in September 2023. Link

Tether, world’s largest stablecoin, creates unit focused on AI models to address real-world challenges. Link

🏗️ Start-ups & Tools to Watch

LimeChain: A leading blockchain consulting & development agency with 120+ chain-agnostic devs. Link*

*partner of Dematerialzd.

💰 Money Moves

0G Labs: Blockchain developer raised $35M pre-seed funding to build scaling infrastructure for on-chain AI apps.

MyShell: Dragonfly Leads $11M Pre-Series A Round for Web3 AI Platform. Link

Parallel: Secures $35M Funding for Sci-Fi NFT Card Game. Link

Optimism to grant $3.3B in OP tokens to top ecosystem contributors. Link

That’s all for now, folks. Thank you for being part of the journey.

Talk soon,

– Marc

PS: Follow me on LinkedIn and X for shorter insights.

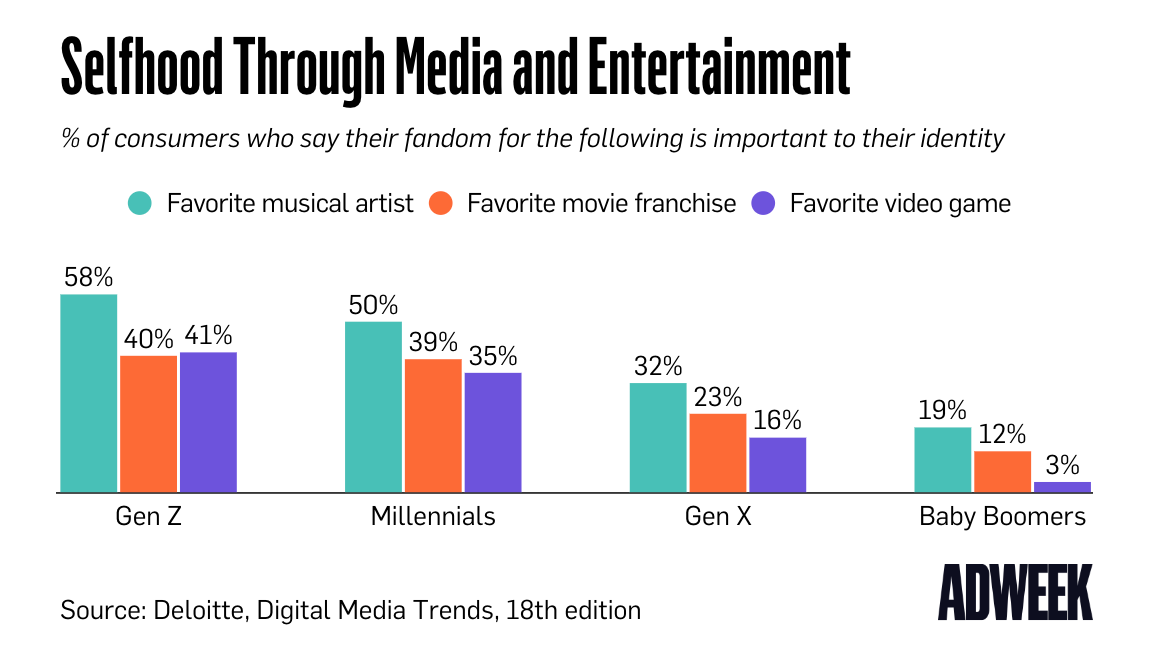

📈 Top 3 Charts to Share with Friends

👩💻 Top Web3 Marketing Jobs:

… more.

Are you hiring? Get listed here →

Partner with us

⚡️ Bring Your Brand or Web3 Business to the Next Level

Together with our global network of technology and execution partners, we accelerate consumer brands to unlock next-gen consumer growth across Web3 and emerging technologies.

We’re also to offer our partners exposure to thousands of b2b Web3 industry leaders & access to the Dematerialzd network to grow your business.

For advertisements: Get in touch today

For partnerships: Reply to this email.

👉 More feedback? We would love to hear from you! Just reply to this email.

Partner of Dematerialzd

cool, thanks Marc!